Bookkeeping

Accounting for Sales Return: Journal Entries and Example

Understanding your sales returns and allowances and how to find them rests on your understanding of a couple of terms. The first term is debit, meaning an addition to an expense or asset account or a decrease to a liability or equity account. In the context of returns and allowances, it means expanding your returns and allowances account. A sales journal entry is a bookkeeping record of any sale made to a customer. You use accounting entries to show that your customer paid you money and your revenue increased. Sales Returns and Allowances is a contra-revenue account deducted from Sales.

Accounting for Sales Returns

This sales return allowance account is the contra account to the sales revenue account. A sales revenue journal entry records the income earned from selling goods or services, debiting either Cash or Accounts Receivable and crediting the Sales Revenue account. As mentioned above, sales return and allowances is a contra account of sales revenue account.

Get Any Financial Question Answered

So once this entry is posted, inventory will be increased, and the cost of goods sold will be derecognized. Initially, the specific details of the sale are identified, including the amount, whether the transaction is for cash or on credit, and the date of the sale. This means that you have allowed return of goods or given back money to your customers. The two accounts involved in this entry are the “Sales Return account” and the “ABC Corporation” (Debtor’s) account. Unreal Corporation sold raw materials worth 10,000 on credit to ABC Corporation.

Scenario 2: Credit Sale

It’s important to note that a sales return only applies when goods are returned; services cannot be returned like physical products. This entry details how much money has been refunded or credited to customers from purchases and is used to keep track of sales transactions. The company may grant a reduction of the purchase price to customers so that customers can keep the goods. In this case, the customers do not need to return goods back to the company.

Treatment of Sales Returns in the Financial Statements

Sales return and allowances are the contra account of the sales revenue account. Companies use various tactics to increase their sales and revenues. As mentioned, some companies offer credit sales which can increase these numbers.

Do you own a business?

If no sales returns and allowances account is there, the revenue reversal entries will be different (as shown below). It’s critical to understand sales returns and allowances when determining how your business is doing and where it might be going. If your returns and allowances are disproportionately high relative to your sales, there could be flaws in your product or the public’s stocksfortots perception of your company. The company, in the interest of its commitment to customer service, offers a $20 partial refund. The company sends them the money, and its accountant debits $20 to its sales and allowances while crediting $20 to its accounts receivable. Sales returns and allowances account for one of the most important categories you’ll find on an income statement.

Some others may also provide customers with various allowances or offer them sales returns. Before understanding how to record sales returns and allowances, it is crucial to define what these are. A contra-revenue account is a liability from revenue which helps in determining whether to omit certain sales transactions, which would otherwise be mistaken as revenue. It is usually included if there are any sales returns and allowances or other type of return not recorded in the sales journal.

In the seller’s books, a return or allowance is recorded as a reduction in sales revenue. Since the sales account normally has a credit balance, returns and allowances could be recorded on the debit side (the reduction side) of the sales account. The sales revenue journal entry is fundamental to financial accounting as it impacts the income statement directly, showing the operational income generated from core business activities. To record a returned item, you’ll use the sales returns and allowances account. This account is for deductions from revenue that result from returns or allowances. This means that when you debit the sales returns and allowances account, that amount gets subtracted from your gross revenue.

- Sometimes due to various reasons goods sold by a company may be returned by the respective buyer(s).

- It’s important to note that a sales return only applies when goods are returned; services cannot be returned like physical products.

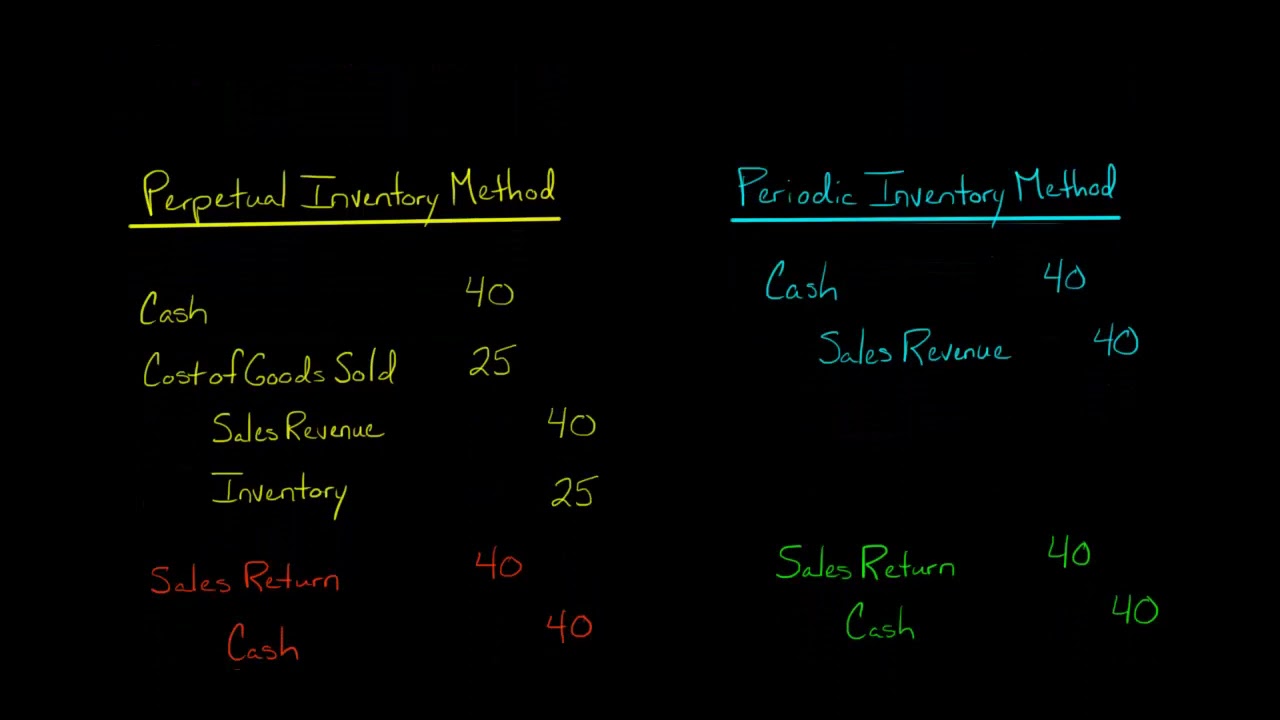

- There are two approaches for making journal entries of transactions related to sales returns and allowances.

- Sales returns occur when a customer returns goods to the seller due to some fault, while the term sales allowance is used when the buyer agrees to keep the products, but for a lesser price.

- Sales returns and allowance are the contra account to the sales revenues where the previously recognized sales need to be derecognized by recording into this account.

- The second approach is more convenient for companies that experience too many such transactions during the year.

Therefore, the customer returns such goods back to ABC Co with a value of $500. Please note that accounts receivable is credited in case of Club B because the amount was still outstanding at the time of the sales return. If you have accounting software or a bookkeeper, you may not be making these entries yourself.

Finally, if your state or local governments impose a sales tax, then your entry will show an increase in your sales tax liability. Let’s review what you need to know about making a sales journal entry. But it’s still important to make sure that there’s an accounting record of every sale you make. This way, you can balance your books and report your income accurately.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. A control account allows you to easily follow the balances of related accounts by following the balance of the control account. The accounts that are related to each other (the ones with the same column heading) are said to be controlled by or linked to each other, and they share a common control account. The original memo is sent to the customer and the duplicate copy is retained.