未分類

Just how many Business days in the annually? 2025 Trading Calendar & Tricks for Date People Go out Change Site

During the attacks which have a lot fewer business days, such as much as holidays, industry exchangeability is also disappear. This leads to greater quote-ask develops and a lot more obvious rates movements, so it is difficult to do large sales instead impacting the new asset’s rates. How many trading days impacts monetary planning, collection management, and also the complete analysis away from industry choices.

If you exchange futures such as MNQ otherwise Silver, it’s especially important to stay conscious of these alterations. Locations rarely struck which exact count each year on account of unplanned closures, nevertheless’s the new nearest guess people explore to possess annual believed. Some transfers in the usa proceed with the trading agenda put because of the New york Stock-exchange, never assume all create. One renowned exemption is the You thread industry, and therefore observe a calendar closer to the us government’s vacation agenda.

Established in 2023, the platform is actually serious about unraveling the complexities of your crypto industry. Dive to your actual-go out status, exclusive interview, and you may insightful blogs readily available for all quantities of solutions. Whether you are an experienced individual otherwise a newcomer, More than Money is your leading publication, delivering quality and knowledge in the previously-developing land away from decentralized finance. Foreign segments are not the only areas having a different dates. This information tend to speak about whom establishes the brand new exchange agenda, as to why it varies from year to-year, and everything else your’ll want to know when determining your trade agenda. © 2025 Greenlight Funding Advisors, LLC (GIA), an SEC Entered Money Coach will bring money consultative features to help you its subscribers.

How features digital exchange changed the market?

Find out how of numerous business days come in per year and package your industry actions effortlessly. Digital exchange can hold additional dangers for example straight down liquidity and you will highest volatility, especially outside of regular exchange instances. It https://evexproject.com/ patchwork schedule brings a diverse tapestry of operational weeks you to international investors must display screen so you can line up their tips around the certain segments. Investment actions, specifically those which can be much time-name, must consider the occurrence of working days in the specific symptoms in order to improve entryway and you may log off issues. Trading that’s over both before and after the standard stock exchange working occasions is known as lengthened-days trade.

Chance Government:

The flexible evaluation program work within the basic exchange calendar to offer all buyer a good chance to demonstrate its feel. If you are looking to have structure, the first and you may next house (January in order to Summer) are felt an informed to own productive go out traders. Such months tend to have more powerful fashion, a lot more frequency, and foreseeable price step. January usually brings the newest times for the places on the “January Feeling”—a tendency to own quick-cover stocks to go up while the traders reset to your new-year. Of many traders consider Saturday early morning because the “mindful money.” Traders is actually absorbing week-end development, waiting to the reports, or perhaps not racing within the.

Segments usually close early weeks before these types of getaways, impacting exchangeability. Such, investments wear the very last go out prior to a great about three-day weekend can get deal with slower execution. Remain informed because of formal exchange announcements to stay to come.

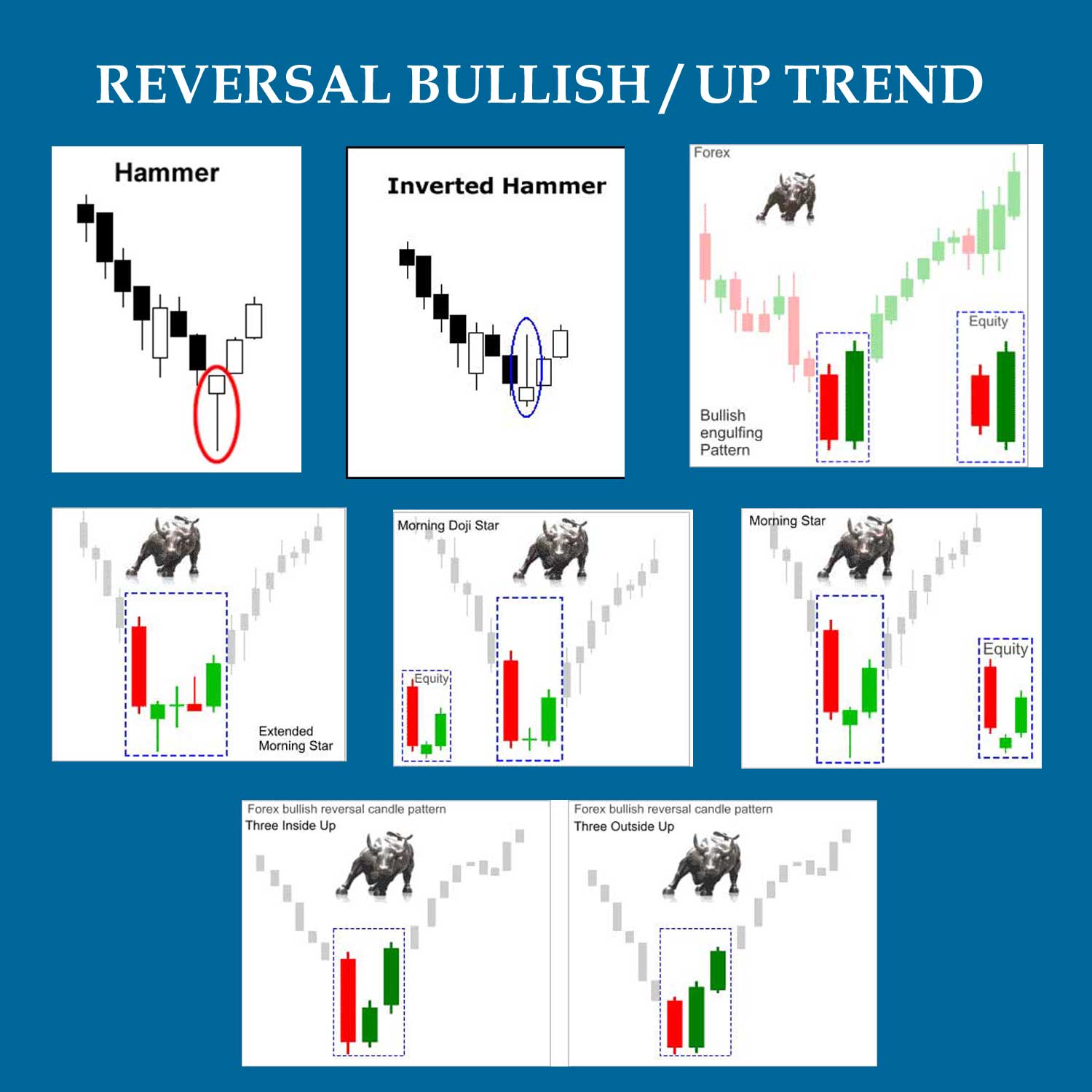

Our courses, designed to help you learn how to trade, protection everything from wise selling and buying choices for the subtleties out of manner and you can candlestick designs. The way send needs well-balanced attention to each other quantitative and you will qualitative measurements. Wise traders blend conventional metrics which have growing innovation while maintaining attention to your sustainable growth patterns.

- The fresh 80/20 code from exchange, known as the brand new Pareto Idea, states one to as much as 80% of exchange payouts are from simply 20% of one’s positions.

- For some investors, today are used for reviewing during the last month’s results or perhaps getting a rest.

- Focusing on how of several business days you will find within the per year and you will information trade lessons is vital for everyone active in the places.

- One renowned different is the United states bond industry, and therefore pursue a schedule nearer to the us government’s vacation plan.

- That it diary means typical trading days, vacations and you may unique market instances.

- We’ll walk-through the details inside a flush, easy-to-discover style to make sure the content is actually optimized and you may its useful to subscribers searching for it precise matter.

Industry Assessment

Overall performance dimensions produces the origin to own trading upgrade round the those individuals 252 industry weeks each year. Research implies that traders which manage detailed results metrics features a 63% high rate of success than others just who track occasionally or otherwise not whatsoever. Everyday reflection otherwise mindfulness behavior assists in maintaining emotional equilibrium during the industry volatility. Of several winning buyers initiate its day having minutes of hushed reflection just before examining people business investigation. So it produces intellectual place between personal really worth and you may change results. Overall, even when, you’re also thinking about as much as 252 trading days outside of the 365 otherwise 366 months in the a year to own U.S. equities.

Annualized efficiency try computed using 252 business days, perhaps not 365 schedule weeks. The fresh Sharpe ratio, a measure of risk-modified efficiency, incorporates the newest square-root out of trading days (√252) to possess annualization. Volatility calculations, such as simple deviation, are also considering trading days unlike diary months. Exchange date adjustments are very important to own evaluating overall performance around the additional time symptoms otherwise locations having varying exchange times. Buyers make use of these metrics to check money managers, assess funding tips, and make told behavior in the collection allocations.

In case your seasons begins on the a friday, there’ll be 106 sunday weeks because seasons, which could slow down the quantity of working days, even if the season try a step season. Election months can result in increased volatility on the segments but barely affect the final amount away from business days unless of course proclaimed a societal holiday. The fresh LSE usually has regarding the 255 trading days annually, somewhat more than the You.S. counterparts due to a lot fewer social vacations in the uk. Federal holidays impacting You trading tend to be both fixed schedules (Christmas time, Liberty Time) and you may floating holidays (Art gallery Go out, Labor Time) you to change a-year.

Proper schedule considered concerns determining high-possibility episodes, to stop tricky business requirements, and you can structuring desires around sensible trade date standard. Overall performance record advances whenever lined up with genuine business availableness. Means time becomes important whenever business days team otherwise pass on unevenly throughout the year. Regular models, escape outcomes, and you will quicker liquidity attacks all require tactical adjustments to keep up consistent results.

Such getaways can be significantly impact trading points while the field shuts, impacting exchangeability and you may volatility. Knowing these types of booked closures assists buyers prevent the surprise from attempting to trade for the an industry getaway, that is such disruptive to possess day exchange procedures. To possess reveal list of the NYSE holidays and how it you are going to apply to the exchange 12 months, go to the review of the fresh NYSE holiday agenda.