未分類

What is actually Cellular View Deposit and just how Does it Work?

Articles

The brand new implementation of blockchain technical you are going to increase the shelter and you can openness of cellular deals. Simultaneously, the fresh widespread access to biometric screening could possibly get after that reinforce security features. You could potentially help prevent ripoff by the contacting the financial institution that is listed because the a’s issuer to ensure the newest view’s authenticity. Simultaneously, be skeptical out of unfamiliar people providing to deliver you money. But We’ve understood individuals to destroy a check too-soon, only to discover a contact a couple instances later on inquiring her or him to carry the brand new check out a part because of a mobile put error. For many who put the view out of your cellular telephone, you wear’t need to make a different trip to the lending company.

Mobile attempt put features revolutionised exactly how we handle deposits, offering a fast and easy banking revel. Embrace the efficacy of cellular view deposit and clarify your own banking delight in now. Cellular deposit setting people is deposit checks 24/7 and prevent vacation in order to a physical financial or borrowing from the bank relationship part. Money from mobile view deposits are usually offered the following day, versus four working days to own a magazine consider. Shell out by Cellular casinos are thought safe with their have fun with from secure mobile charging you procedures.

Deal with Payments

Within the last six many years, he’s got mutual his educational degree for the rise of modern payment steps, click site installing himself while the the percentage steps specialist. Be sure to look at your chose gambling enterprise caters the fresh currency you to you wish to have fun with in advance to quit dissatisfaction and you will frustration. BT ‘s the merely United kingdom operator to let repayments by landline, catering to help you users whom can be away from an adult generation and less likely to want to own a cellular phone. It’s as well as a terrific selection for participants who lose the mobile phones however, wear’t have to lose out on looking to the luck on the web. Consult your service provider to possess specifics of specific fees and you can costs.

If you’re also utilizing the Money You to Mobile application, before you can publish an image of your consider, the brand new application often notify you to the applicable limits. If you want to deposit an amount that’s over the brand new limitation, go to one of our twigs or ATMs. Extremely banks do not allow mobile places of 3rd-people monitors, whether or not he could be signed off to you. This type of monitors always have to be transferred in the a department that have right character. If your lender now offers cellular consider put and also you refuge’t tried it but really, unlock the new application the very next time you get a check.

Try to bring your membership back to a confident balance prior to in initial deposit. In this instance, your own deposit count exceeds the new every day restrict by $five-hundred. You would have to both wait until the following day to help you deposit the newest look at or get hold of your lender in order to demand a high limitation. Mobile money is a fairly secure commission approach you to definitely scores of someone worldwide play with daily, and you have absolutely nothing to worry providing you is actually transacting that have a professional broker. Make sure to like a trustworthy and you can credible representative from the checking our listing of the greatest trading systems one to undertake cellular currency deposits. Join a brokerage who’s low exchange fees to ensure you get the most value out of each and every cellular put.

While the lowest daily restriction might become limiting to possess big spenders, everyday participants that trying to control its money will get that one best. During the NewCasinos, we’re invested in taking unbiased and you will truthful recommendations. All of our loyal benefits carefully carry out within the-breadth research on each webpages whenever researching to make sure we are objective and you will total. Our recommendations try designated after the reveal rating program centered on tight standards, factoring inside the certification, video game possibilities, percentage steps, safety and security actions, or other things. Multiple prepaid card issuers give cellular deposits, which allow one explore an android os otherwise apple’s ios software to help you put a on the prepaid credit card.

To bring images of one’s take a look at, really cellular banking programs show you that have an overview of your review your screen. The new software can also make photos for you once you’ve dependent the new sign in your own tool’s digital camera viewfinder or have you use the images. You’ll need to do which for both the front and back of your own consider. You could deposit very kind of monitors directly into their examining account otherwise family savings having fun with Wells Fargo mobile put. Eligible view versions tend to be personal, company and most bodies inspections. View Places greater than $10,100000 Once again, depending on the bank, you do not be allowed to deposit your $ten,100000 look at via mobile deposit on your cell phone, otherwise during the an atm.

- Cellular take a look at put try a financial element where customers bring a photo of a check within establishment’s cellular financial app and you may submit it about.

- Even though cellular look at deposits are simpler, some banking companies charges costs to possess certain features.

- Including, set a white review a dark-coloured table before taking the new photos.

- System Checking account that will be over 3 months dated is also put as much as $twenty-five,100 via a mobile.

- You will see it in your listing of previous deals within one business day.

All of our standard plan would be to allow you to withdraw currency transferred in your membership no later on compared to the next working day just after your day we prove the newest receipt of the deposit. Chase also provides among the better checking account bonuses out there, however, so it financial as well as enables you to deposit to $dos,000 daily otherwise $5,100000 monthly once you make cellular deposits. Rapidly put checks in to your qualified HSBC checking or offers account using the digital camera on the iphone 3gs, iPad, otherwise Android os™ equipment and the HSBC Cellular Banking app@appinfo. Your financial organization and its mobile financial software may have book instructions and requirements, so be sure to opinion the required process so you can put a register your app. Their financial otherwise lender will likely request you to label the take a look at as the a mobile consider put using your signature.

Become familiar with your own lender’s cellular application functionalities. Regular play with will assist you to be much more at ease with the method and you can improve your banking feel. Some banking companies impose limitations for the number you can deposit because of mobile look at deposit.

But not, an educated banking institutions for mobile banking make their application an interest of their solution and then try to make deploying it incredibly affiliate-friendly. Cellular Take a look at Put makes you get an image of the front and back of one’s recommended check with the new mobile software as well as your device’s digital camera. Merely discover membership you need the new view placed to your and go into the number of the fresh view. Then you fill in the order to HSBC through the mobile software and we will process the brand new consider.

What is actually a mobile look at deposit? Here’s all you have to understand

Just ensure you get your salary from the employer, discover the fresh application at the table and put your own register under a few times. Consumers with a qualified HSBC savings otherwise checking account. You truly must be registered for personal Web sites Financial and now have installed a current sort of the fresh HSBC Mobile Financial Software.

Other Discover Points

Cellular consider deposit are a key section of today’s electronic banking land and you can an extremely well-known ability of your programs that are transforming people’ on the web banking feel. This technology provides an even more smoother, productive, and safe method of getting inspections to the accounts, gaining one another financial customers as well as their associations. To begin, download the brand new Seacoast Mobile Financial app1 and you will log in with your on line banking account. Cellular look at deposit is secure, making use of security to be sure the protection from transactions.

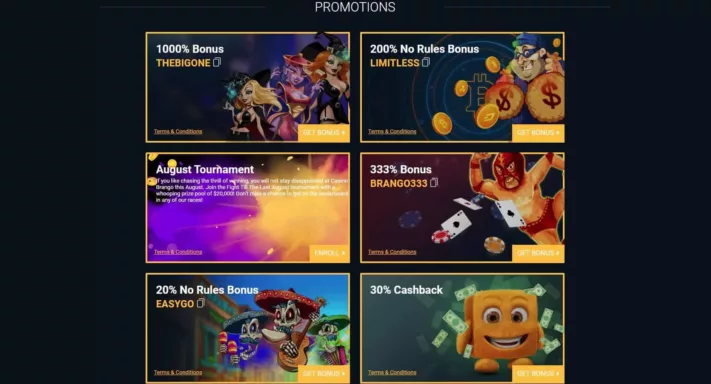

Most other team including Yards-Pesa charge a rate for each transaction, for the matter you have to pay scaling to your sized the fresh put. Although not, the funds may possibly not be available for a few hours so you can a short while, depending on your own seller’s principles. Here, you could go to the ‘Payment Method’ filter and select the seller. You will want to up coming find all of the gambling enterprises that offer incentives and you will accept that strategy. To see the new shell out-by-cell phone sites that have introduced our very own tight analysis that have flying colors, then purchase the ‘Recommended’ filter out. Talking about most likely to treat their clients better and supply a set of video game, making them an educated bet for an optimistic gaming sense.

Banks provides differing every day, per week, and you may month-to-month limits to your cellular take a look at places, therefore look at your financial arrangement. For many who come to a cellular look at deposit limitation, you are in a position to deposit additional checks individually. A cellular view put takes one or more full business day in order to processes. If you would like their finance available quickly, some financial institutions tend to procedure your look at instantaneously however, want you to expend a charge. So it percentage is often a small percentage of your take a look at, around 1% to cuatro%. Discover’s Mobile View Put is fast – breeze photographs of one’s closed look at and you may publish her or him within a few minutes to deposit these with the cellular app.